Managing your finances doesn’t have to be complicated or stressful. With simple accounting software, you can take control of your money quickly and easily—no accounting degree needed.

Imagine having all your expenses, invoices, and reports organized in one place, saving you hours of guesswork and paperwork. If you want a tool that makes bookkeeping straightforward and helps your business run smoother, keep reading. This guide will show you how to find the perfect simple accounting software that fits your needs and helps you stay on top of your finances with confidence.

Benefits Of Simple Accounting Software

Simple accounting software offers many benefits for small businesses and freelancers. It helps manage finances with less stress and fewer errors. The software is designed to be easy to use and saves time on routine tasks.

Many users find it reduces the need for deep accounting knowledge. It also lowers costs compared to hiring professional accountants. Simple tools can improve the accuracy of financial records, making business decisions easier.

Time-saving Features

Simple accounting software automates many manual tasks. It quickly records income, expenses, and invoices. This saves hours that would be spent on paperwork. Users can generate reports with just a few clicks. The software also helps track payments and send reminders automatically.

Cost-effective Solutions

These tools often cost less than complex accounting programs. Small businesses can avoid expensive accounting fees. Many options offer monthly plans that fit tight budgets. The software reduces the need for extra staff. It allows business owners to handle finances on their own.

Improved Accuracy

Simple accounting software reduces human errors in calculations. It automatically updates records as transactions occur. The software checks for inconsistencies and alerts users. Accurate data helps with tax filing and financial planning. It builds trust in business reports and statements.

Credit: www.simpleplanning.net

Key Features To Look For

Choosing simple accounting software means focusing on features that save time and reduce errors. The right tools help manage finances clearly and quickly. These key features make accounting easier for small business owners and freelancers.

User-friendly Interface

A simple interface means less confusion. Easy menus and clear labels help users find what they need fast. No complex steps. Just straightforward options to track income, expenses, and budgets. This feature helps users avoid mistakes and learn the software quickly.

Automated Invoicing

Automated invoicing sends bills to clients without manual work. It saves hours every month. Users can create, send, and track invoices automatically. The software can even send reminders for unpaid bills. This keeps cash flow steady and reduces late payments.

Real-time Financial Reports

Real-time reports give instant updates on money matters. Users see profits, losses, and expenses as they happen. This helps make smart decisions fast. Reports are clear and easy to read. They show the financial health of the business at any moment.

Multi-device Access

Access accounting software on phones, tablets, or computers. This flexibility lets users work from anywhere. Changes sync across devices instantly. It keeps data safe and up to date. Multi-device access supports busy people on the go.

Choosing The Right Software

Choosing the right simple accounting software can save time and reduce errors. The right software fits your business needs and budget. It helps track income, expenses, and taxes easily. Picking software that is easy to use makes accounting less stressful.

Assessing Business Needs

Start by listing what your business needs from the software. Consider the number of transactions you make monthly. Think about whether you need features like invoicing, payroll, or inventory tracking. Identify your budget for software expenses. Make sure the software suits your business size and type.

Comparing Popular Options

Look at well-known simple accounting software options. Compare their features side by side. Check if they offer mobile access or cloud storage. See if the user interface is clear and easy to navigate. Read reviews from users with similar business types. Check the pricing plans and what each includes.

Evaluating Customer Support

Good customer support saves frustration during software use. Find out if support is available by phone, chat, or email. Check the hours of availability to match your working hours. Look for quick response times and helpful answers. Some software offers tutorials and forums, which can be useful. Choose software with reliable and friendly customer service.

Credit: www.youtube.com

Integrating Software With Existing Systems

Integrating simple accounting software with your current systems makes your business run smoother. It helps keep all your data in one place and reduces errors. Proper integration saves time and improves accuracy in your financial tasks.

Planning the integration process carefully leads to better results. It ensures your software works well with other tools you use. A smooth setup means less downtime and fewer problems for your team.

Data Migration Tips

Start by backing up all your existing data. Check for duplicates and clean up any outdated information. Use tools that support easy transfer to the new software. Test the data after migration to make sure nothing is lost.

Ensuring Compatibility

Check if the new software supports your current hardware and systems. Look for software that works with your operating system and other apps. Confirm it can handle the file types you use. Compatibility avoids crashes and delays.

Training Your Team

Teach your staff how to use the new software clearly and simply. Use step-by-step guides and short training sessions. Encourage questions and provide real examples. Confident users reduce errors and speed up work.

Maximizing Efficiency With Automation

Automation in simple accounting software saves time and reduces errors. It helps businesses focus on growth by handling routine tasks. Automation simplifies many accounting processes, making work faster and easier.

Automated Expense Tracking

Automated expense tracking records costs instantly. It connects with bank accounts and credit cards to import transactions. This reduces manual data entry and prevents mistakes. Users can categorize expenses quickly and see real-time reports. It keeps spending organized and easy to manage.

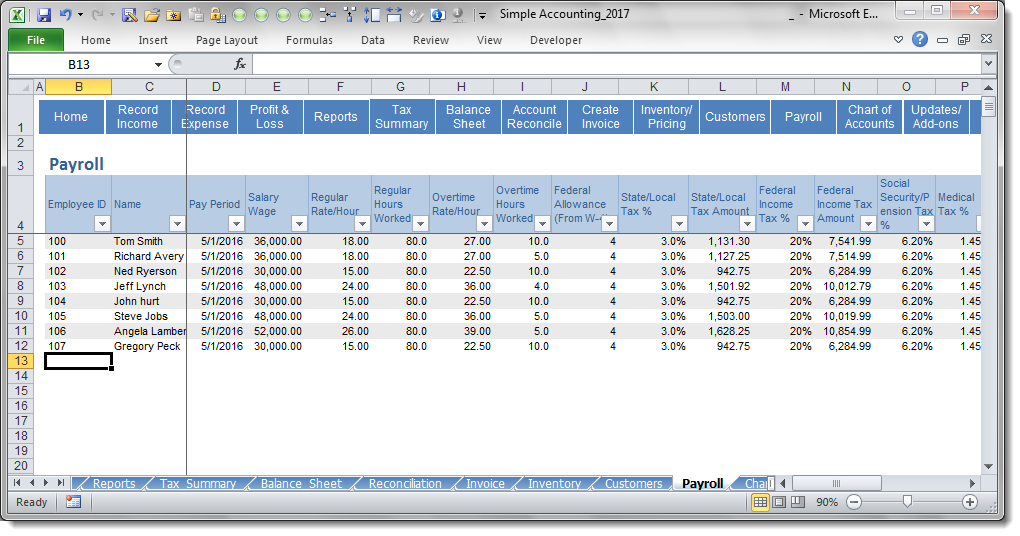

Streamlining Payroll

Payroll automation calculates salaries and taxes automatically. It sends payments on schedule without delays. This process ensures employees get paid correctly every time. It also generates payslips and handles tax forms. Payroll becomes simpler and saves time for small businesses.

Scheduling Regular Reports

Automated report scheduling creates financial statements on set dates. Reports like profit and loss or cash flow arrive in your inbox without effort. This helps track business health regularly. Scheduled reports keep owners informed and ready to act fast.

Credit: en.wikipedia.org

Common Challenges And Solutions

Simple accounting software helps many small businesses manage their finances. Yet, users often face common challenges. These issues can slow down work or cause confusion. Knowing solutions makes the process easier and more efficient.

Handling Software Updates

Software updates improve features and fix bugs. But updates can interrupt work if not planned well. Schedule updates during off-hours to avoid disruption. Always back up data before starting the update. Check for update notes to understand new changes.

Data Security Concerns

Financial data is sensitive and must stay safe. Use strong passwords and change them regularly. Enable two-factor authentication when possible. Store backups in secure locations. Avoid sharing login details with others to prevent breaches.

Troubleshooting Errors

Errors happen even in simple software. Identify the problem by reading error messages carefully. Restart the software or computer to clear minor glitches. Consult the help section or user guide for solutions. Contact customer support if the issue persists.

Frequently Asked Questions

What Is Simple Accounting Software?

Simple accounting software is an easy-to-use tool for managing financial tasks. It helps track income, expenses, and invoices without complexity. It suits small businesses and freelancers who need basic bookkeeping without advanced features.

How Does Simple Accounting Software Save Time?

It automates tasks like invoicing, expense tracking, and report generation. This reduces manual data entry and errors. Users can focus on business growth instead of paperwork, making accounting faster and more efficient.

Can Beginners Use Simple Accounting Software Easily?

Yes, simple accounting software is designed for beginners. It features intuitive interfaces and clear instructions. Users don’t need accounting knowledge to manage finances effectively and accurately.

What Features Should Simple Accounting Software Include?

Key features include invoicing, expense tracking, bank reconciliation, and basic reports. Integration with payment gateways and tax calculation tools is beneficial. The software should be user-friendly and accessible on multiple devices.

Conclusion

Simple accounting software saves time and reduces errors. It helps track income and expenses clearly. Small businesses can manage finances without stress. Easy tools make bookkeeping less confusing and more accurate. Choosing the right software supports better money decisions. Start with basic features that fit your needs.

Keep your records organized and up to date. Simple solutions bring confidence in managing your accounts. Try one today to see the difference it makes.