Managing your small business finances can feel overwhelming. You want to keep track of every dollar without spending hours buried in paperwork.

That’s where online bookkeeping software comes in. Imagine having a simple tool that organizes your expenses, tracks income, and gives you clear reports—all in one place. This can save you time, reduce errors, and help you make smarter decisions for your business.

If you’re ready to take control of your finances without the hassle, keep reading. We’ll show you how the right online bookkeeping software can transform your business and make your life easier.

Benefits Of Online Bookkeeping

Online bookkeeping software offers many benefits for small businesses. It simplifies managing finances and improves accuracy. Business owners save time and avoid common mistakes. This software helps keep financial data organized and easy to access.

Using online bookkeeping tools lets you work from anywhere. It automates many daily tasks, freeing up time to focus on growing your business. These advantages make online bookkeeping a smart choice for small business owners.

Save Time And Reduce Errors

Manual bookkeeping takes many hours and often leads to mistakes. Online software speeds up data entry and calculations. It reduces human errors by automatically updating records. This saves time and ensures your financial reports are accurate.

Access Data Anywhere

Cloud-based bookkeeping software lets you access your data from any device. You can check your accounts at home, office, or on the go. This flexibility helps you stay informed and make quick decisions about your business.

Automate Routine Tasks

Online bookkeeping software can handle tasks like invoicing and expense tracking. It sends payment reminders and generates financial reports automatically. This automation reduces your workload and helps keep your business organized.

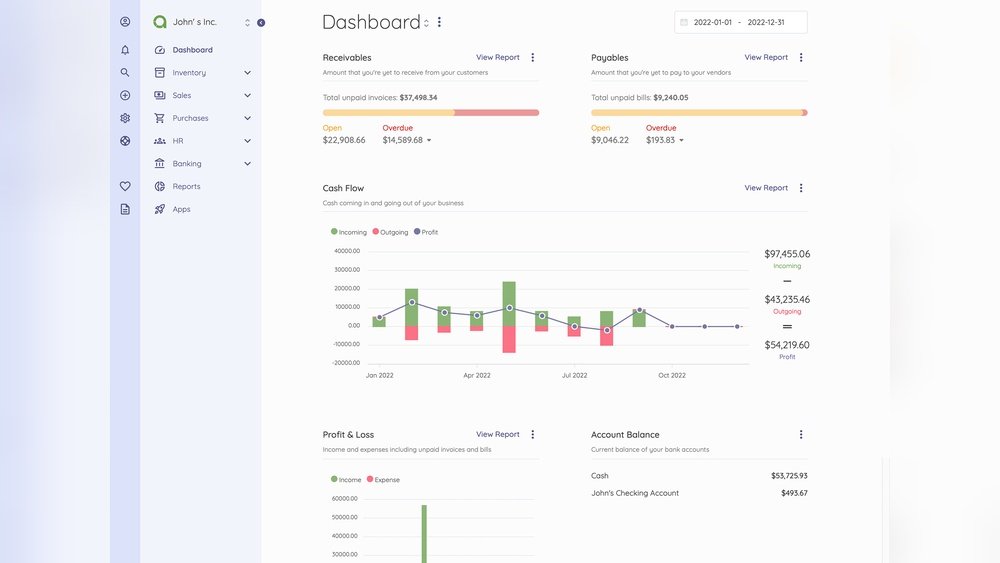

Credit: www.zoho.com

Features To Look For

Choosing the right online bookkeeping software is important for your small business. Certain features can make your work easier and more efficient. Focus on tools that simplify tasks and keep your data safe. These features help you save time and avoid mistakes.

User-friendly Interface

The software should be easy to use. A simple design helps you find what you need quickly. You should not spend hours learning how to use it. Clear menus and helpful guides make the process smooth.

Easy navigation saves time and reduces errors. Even if you are new to bookkeeping, a friendly interface helps you stay on track. Look for software that feels natural to use.

Integration With Other Tools

Your bookkeeping software must work well with other apps. Connecting with banks, payroll, and invoicing tools is key. This connection reduces manual entry and speeds up your work.

Good integration keeps all your data in one place. It helps to avoid mistakes from transferring information by hand. Choose software that fits your existing systems.

Real-time Financial Reporting

Get financial reports instantly with real-time updates. This feature shows your current income, expenses, and profits. You can make quick decisions based on accurate data.

Real-time reports help you track your business health every day. No more waiting until the end of the month. This feature keeps you informed and ready to act.

Secure Data Storage

Your financial data must be protected at all times. The software should use strong encryption and backup systems. Safe storage prevents data loss and protects privacy.

Look for software with clear security policies. Knowing your data is safe gives peace of mind. Trustworthy storage is a must for any bookkeeping tool.

Top Software Options

Choosing the right bookkeeping software helps small businesses stay organized and save time. Many options fit different business needs and budgets. Here are some top choices that work well for small businesses.

Affordable Choices For Startups

Startups need software that costs less but still handles basics well. Programs like Wave and ZipBooks offer free or low-cost plans. These tools manage invoices, track expenses, and create simple reports. They keep finances clear without heavy spending.

Advanced Tools For Growing Businesses

As businesses grow, they need more features. Software like QuickBooks Online and Xero provide advanced tools. These include payroll, inventory tracking, and detailed financial reports. They help manage complex tasks with ease and accuracy.

Cloud-based Vs Desktop Solutions

Cloud-based software stores data online and allows access anywhere. This suits teams working remotely or with multiple devices. Desktop software installs on one computer and works offline. It fits businesses with limited internet access or strict data control needs.

:max_bytes(150000):strip_icc()/GettyImages-1442731807-de72b6667831444298d539e63d58693f.jpg)

Credit: www.investopedia.com

How To Choose The Right Software

Choosing the right online bookkeeping software is key for small business success. The perfect software fits your needs, grows with your business, and offers good support. It should also fit your budget. This guide helps you pick the best option.

Assess Your Business Needs

Think about your daily bookkeeping tasks. Do you track invoices, expenses, or payroll? List the features you need. Consider the number of users who will access the software. Check if you need mobile access or cloud storage. This helps find software that matches your tasks.

Consider Scalability

Choose software that grows with your business. Your needs may change as you add customers or services. Find software that can handle more transactions or users easily. Avoid switching software too often. Scalability saves time and money in the long run.

Check Customer Support

Good support saves time during problems. Look for software with easy access to help. Check if they offer phone, chat, or email support. Read reviews about their response time. Support is important for smooth bookkeeping.

Evaluate Pricing Plans

Compare costs of different software options. Look at monthly or yearly fees. Check if there are extra charges for users or features. Choose a plan that fits your budget. Avoid plans with hidden fees. Clear pricing helps avoid surprises.

Tips For Quick Implementation

Starting with online bookkeeping software can feel tough. Quick implementation saves time and avoids confusion. Follow simple steps to get your system running fast. These tips help your team adapt and keep business smooth.

Set Clear Goals

Know what you want from the software. List tasks you want to improve or automate. Clear goals guide your choices and speed up setup. Share goals with your team to keep everyone focused.

Train Your Team

Teach your staff how to use the software well. Short, easy training sessions work best. Use videos and simple guides for faster learning. Practice helps staff feel confident and ready to use new tools.

Migrate Data Efficiently

Move your old financial data carefully. Check data for errors before transfer. Use tools that help automate data migration. Clean data means fewer problems after setup.

Monitor Progress Regularly

Watch how the software works in real time. Check for mistakes or slow steps often. Ask your team for feedback on the system. Fix issues quickly to keep work smooth and fast.

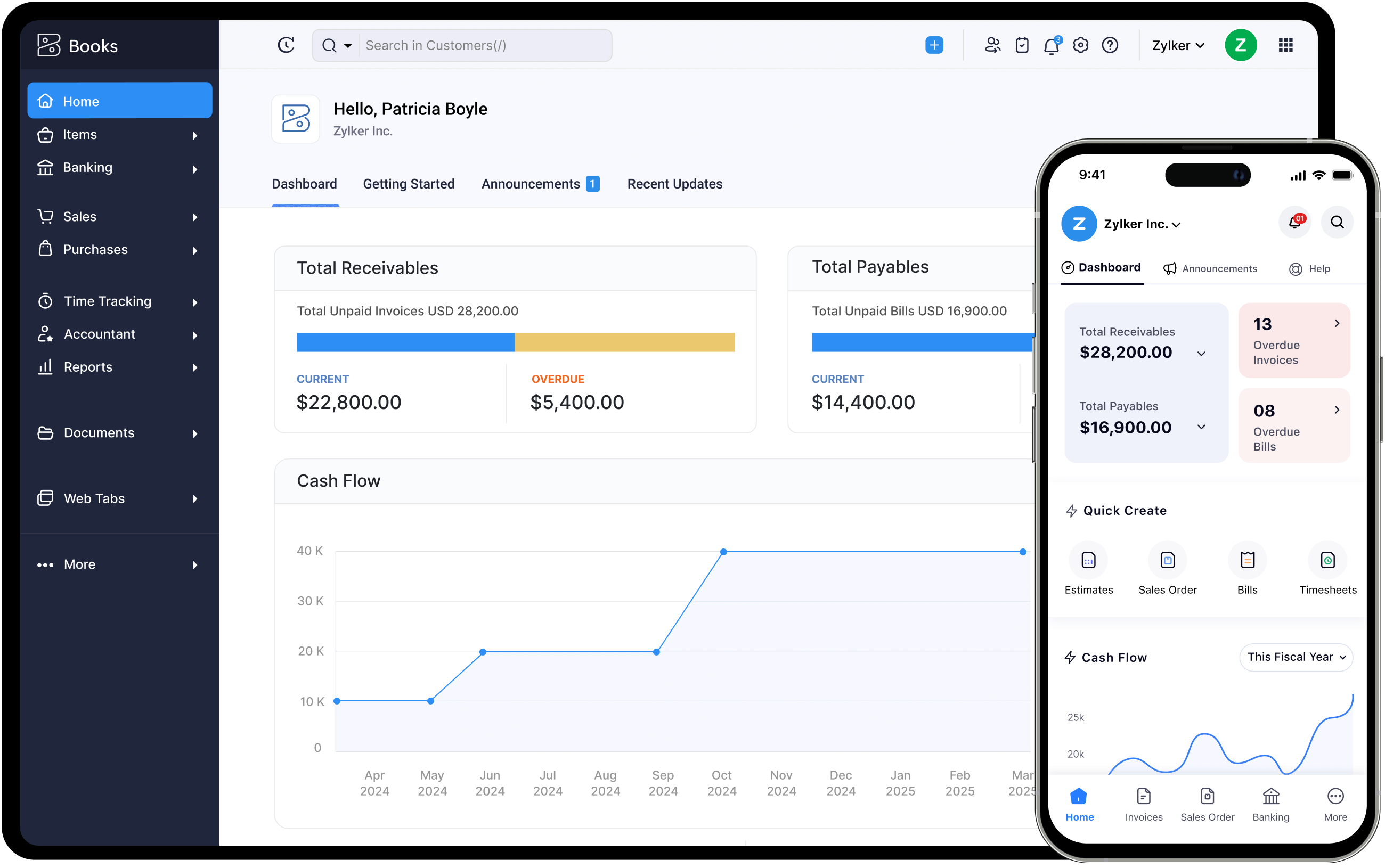

Credit: quickbooks.intuit.com

Frequently Asked Questions

What Is Online Bookkeeping Software For Small Business?

Online bookkeeping software helps small businesses manage finances digitally. It tracks expenses, invoices, and payments automatically. This software improves accuracy, saves time, and provides real-time financial insights for better decision-making.

How Does Online Bookkeeping Software Benefit Small Businesses?

It simplifies financial tasks, reduces errors, and saves time. Small businesses can access data anytime, improve cash flow management, and generate reports easily. It also helps with tax preparation and compliance.

Which Features Are Essential In Bookkeeping Software?

Key features include invoicing, expense tracking, bank reconciliation, and financial reporting. Integration with bank accounts and tax software is also vital. User-friendly dashboards and mobile access enhance usability.

Is Online Bookkeeping Software Secure For Small Businesses?

Yes, reputable software uses encryption and secure servers to protect data. Regular backups and access controls ensure safety. Always choose providers with strong security protocols and compliance certifications.

Conclusion

Choosing the right online bookkeeping software helps small businesses save time. It keeps financial records clear and easy to manage. Many tools offer simple features that anyone can use. This makes tracking income and expenses less stressful. You can focus more on growing your business.

Try different options to find what fits best. Accurate bookkeeping supports smart decisions and smooth operations. Stay organized and watch your business run better.