Are you unsure how to handle software license fees in your accounting? You’re not alone.

Many businesses struggle with recording these costs correctly, which can lead to mistakes on your financial statements. Getting this right is crucial—it affects your taxes, budgeting, and even how investors see your company. You’ll discover clear, step-by-step guidance on how to account for software license fees properly.

By the end, you’ll feel confident managing these expenses and making smart financial decisions for your business. Keep reading to unlock the secrets to smooth, accurate accounting for your software costs.

Types Of Software Licenses

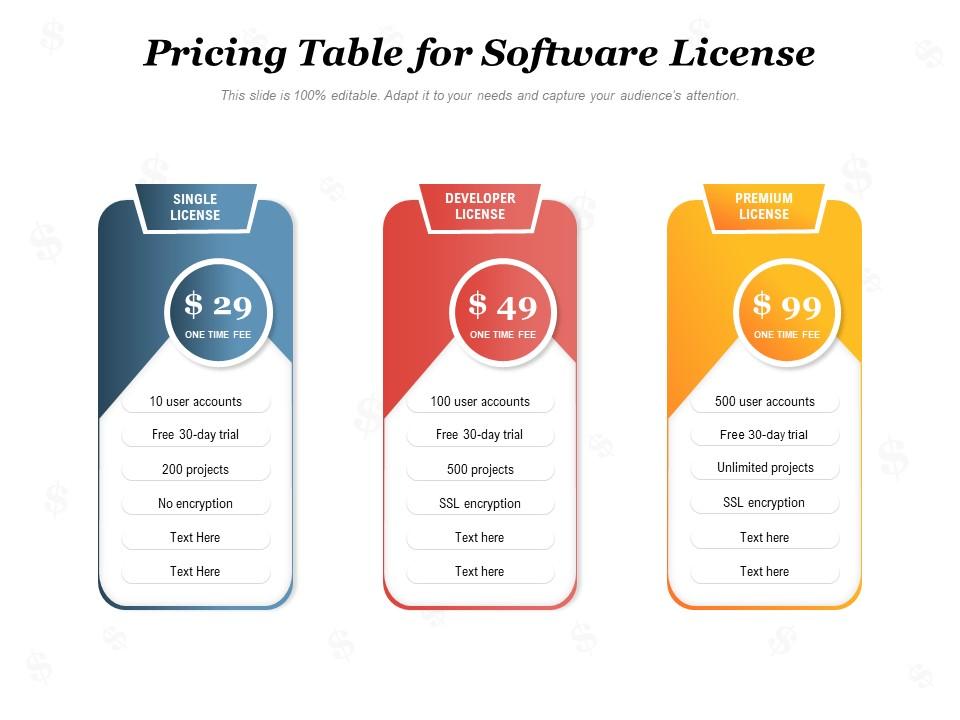

Software licenses define how you can use software and what fees apply. Different types of licenses affect costs and accounting methods. Understanding these types helps you manage expenses properly.

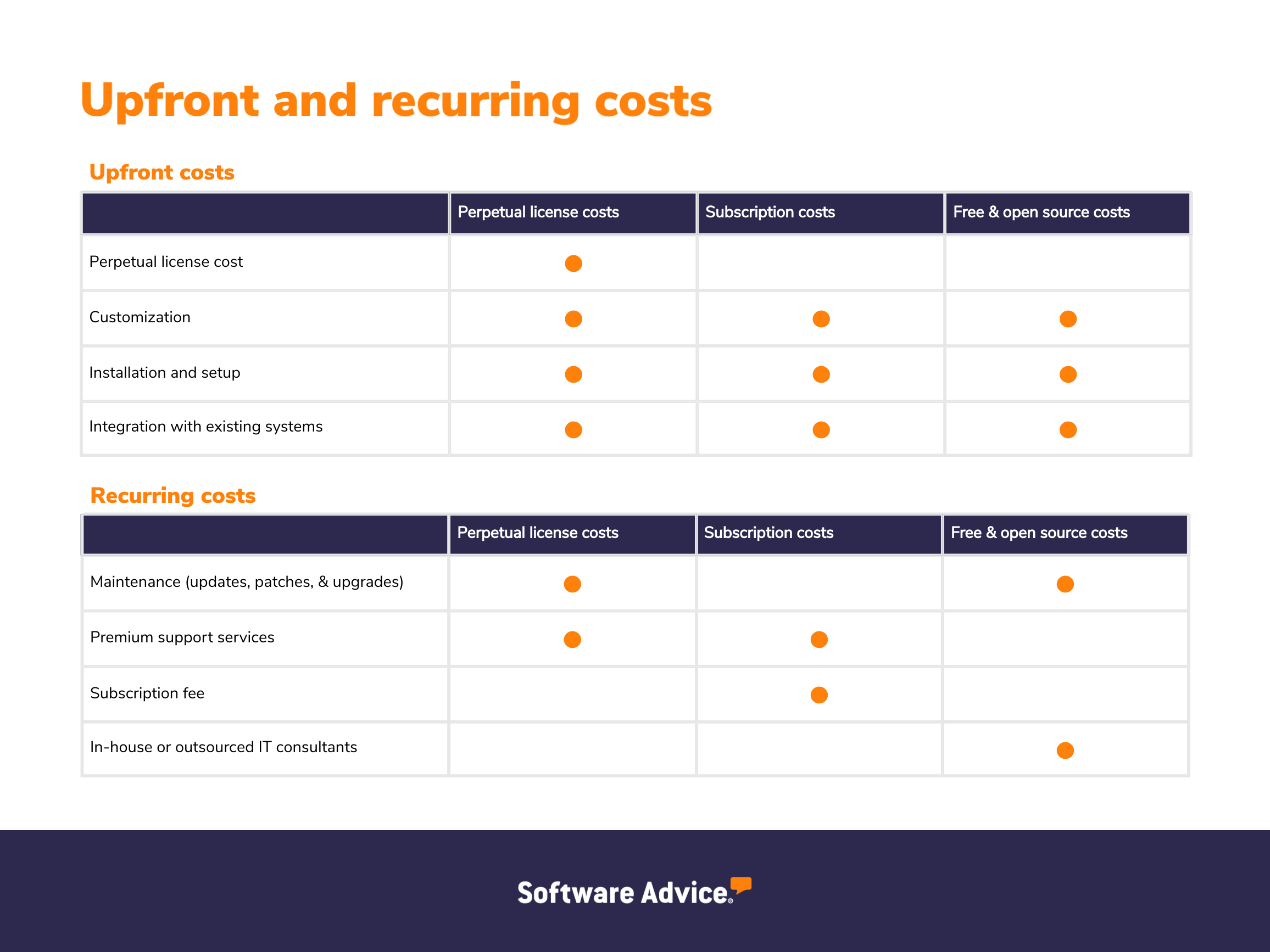

Perpetual Licenses

Perpetual licenses allow you to buy software once and use it forever. You pay a single fee upfront. This fee is often recorded as an asset and amortized over time. Updates or support may cost extra.

Subscription Licenses

Subscription licenses require regular payments, usually monthly or yearly. You access software only while paying. These fees are treated as operating expenses in accounting. They do not create a long-term asset.

Concurrent Licenses

Concurrent licenses limit the number of users who can use software at the same time. Companies buy a set number of licenses for shared use. Fees may be one-time or subscription-based. Accounting depends on the payment model.

Open Source Licenses

Open source licenses allow free software use and modification. They often have no direct fees. Costs come from support or custom development. Accounting focuses on these service costs rather than software purchase.

Credit: www.softwareadvice.com

Accounting Standards To Follow

Understanding which accounting standards to follow helps in recording software license fees correctly. Different rules apply depending on the framework your company uses. This section breaks down the main standards to guide your accounting process.

Gaap Guidelines

GAAP stands for Generally Accepted Accounting Principles. It is used mainly in the United States. GAAP requires companies to expense software licenses based on their use and terms. If the license is a one-time purchase, the cost may be capitalized and amortized over time. For subscription licenses, fees are usually recognized as expenses when paid.

Ifrs Requirements

IFRS means International Financial Reporting Standards. Many countries outside the U.S. follow IFRS. It treats software license fees similarly to GAAP but focuses on the substance of the contract. License fees that give a right to use software over time are spread over the contract period. If the license grants ownership, it is recorded as an intangible asset and amortized.

Revenue Recognition Rules

Revenue recognition rules affect how fees are recorded in accounts. Fees must match the period the software is used. For licenses sold with services, revenue is split between the software and services. This approach prevents overstating income or expenses. The rules ensure that financial statements show a true picture of business activity.

Capitalizing Vs Expensing License Fees

Deciding whether to capitalize or expense software license fees affects your accounting records. This choice impacts how costs appear on your financial statements. Understanding this difference helps manage your business finances clearly and correctly.

Criteria For Capitalization

License fees can be capitalized if they provide long-term benefits. The software must be used for more than one year. Costs must be directly related to obtaining the license. You should have control over the software during its use. Capitalizing spreads the cost over the software’s useful life.

When To Expense Immediately

Expense license fees if they are for short-term use. Fees paid for subscriptions or monthly plans usually count as expenses. Small or incidental costs should also be expensed. Expensing means recording the cost fully in the current period. This approach keeps accounting simple and transparent.

Impact On Financial Statements

Capitalizing license fees increases assets on the balance sheet. Expenses appear gradually through depreciation or amortization. This reduces profits slowly over time. Expensing fees lowers profit immediately but keeps assets lower. The choice affects tax and profit reporting for your business.

Recording Software License Costs

Recording software license costs is important for clear financial tracking. It helps businesses see how much they spend on software. Proper recording also ensures compliance with accounting rules. This process affects financial reports and tax calculations.

Careful recording avoids errors and confusion. It shows the real value of software over time. Let’s explore how to record these costs correctly.

Initial Recognition

Record software license fees as an asset if the license is long-term. Short-term licenses can be recorded as an expense. Use the purchase price as the initial cost. Include any fees necessary to make the software ready for use. Do not mix license costs with other unrelated expenses.

Amortization Methods

Amortize the software license cost over its useful life. Use straight-line amortization for simplicity. Divide the cost evenly across each year. Adjust the period based on the license terms. Stop amortization if the license expires or is no longer usable.

Handling Renewals And Upgrades

Record renewal fees as expenses unless they extend the license life significantly. Capitalize upgrades if they add new features or improve performance. Treat upgrade costs like initial license costs. Separate routine maintenance fees from capitalized amounts. Keep track of all changes for accurate accounting.

Tax Implications Of License Fees

Software license fees affect your taxes in different ways. Understanding these tax rules helps manage costs better. Some fees can be deducted immediately. Others need spreading over time. Knowing tax treatments avoids surprises during audits.

Deductibility Of License Costs

Most software license fees are deductible as business expenses. You can usually write off the full cost in the year paid. This reduces taxable income quickly. Some licenses, especially long-term ones, may need special treatment. Always check if the fee is for a subscription or a one-time purchase.

Depreciation And Amortization For Tax

Some license fees count as assets. These must be depreciated or amortized over several years. This spreads the expense across the license’s useful life. Amortization applies mostly to intangible assets like software licenses. Check your local tax rules for correct periods and methods.

Tax Credits And Incentives

Certain software costs qualify for tax credits or incentives. These reduce your tax bill dollar-for-dollar. Research credits for technology investments or innovation activities. Small businesses may get extra benefits. Always keep detailed records to claim these incentives properly.

Credit: www.slideteam.net

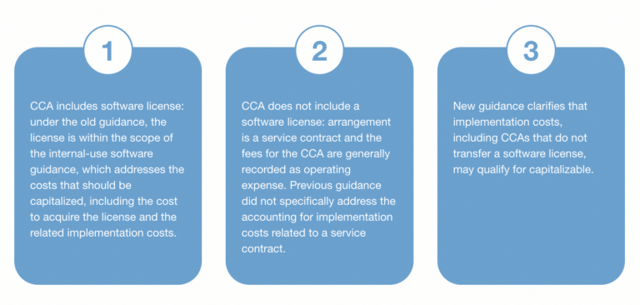

Managing Multi-year License Agreements

Managing multi-year software license agreements requires careful accounting. These agreements often span several years and involve significant fees. Properly handling these fees ensures accurate financial records and compliance with accounting standards.

Spreading the cost over the contract period matches expenses with the benefits received. It also helps businesses plan their budgets clearly and avoid sudden financial hits.

Allocating Fees Over Contract Period

Divide the total license fee evenly over the contract’s life. This method, called straight-line allocation, is simple and widely accepted. It reflects the ongoing right to use the software each year.

Some contracts may have different payment schedules. In those cases, allocate fees based on usage or service delivery timing. Always follow the terms of the agreement for proper allocation.

Adjusting For Changes In Usage

License fees can change if the number of users or usage limits shift. Track these changes regularly and update your records. Adjust your expense recognition to match the new terms.

Ensure all changes are documented and supported by contract amendments. This practice avoids confusion and ensures accurate financial reporting.

Disclosures In Financial Reports

Disclose the nature and duration of multi-year license agreements in financial statements. Include total fees, payment terms, and how costs are allocated. Clear disclosures help stakeholders understand financial commitments.

Report any significant changes or risks related to the licenses. Transparency builds trust with investors and auditors. Always follow accounting rules on disclosures for software licenses.

Common Challenges And Solutions

Accounting for software license fees often involves challenges. These challenges can cause errors in financial records and compliance issues. Understanding common problems helps businesses manage costs better. Solutions exist that simplify tracking and ensure proper accounting.

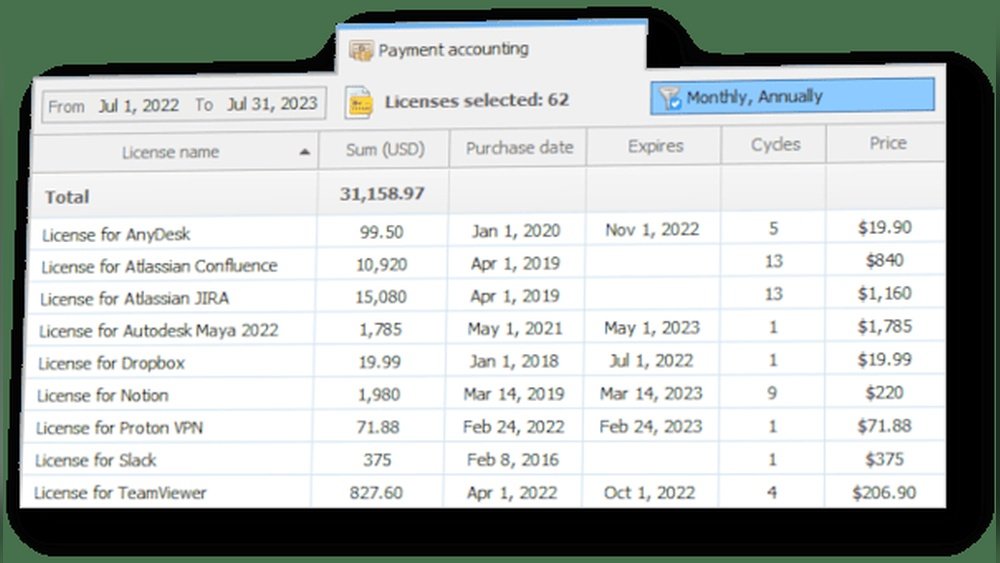

Tracking License Renewals

Keeping track of license renewal dates can be difficult. Missing a renewal may lead to service interruptions or extra costs. Use digital calendars or license management tools to monitor expiry dates. Regular reviews of licenses help avoid unexpected fees. Clear records of renewals improve budget planning and accounting accuracy.

Dealing With Embedded Software

Embedded software often comes bundled with hardware. It can be hard to separate the software cost from the device price. Accountants should allocate costs based on fair value estimates. This approach ensures correct expense recognition over time. Proper allocation avoids misstating asset values or expenses.

Ensuring Compliance

Non-compliance with license terms can cause fines and legal issues. Businesses must understand each license’s rules and restrictions. Conducting regular audits helps detect unauthorized software use. Training staff on compliance reduces risks and improves accountability. Staying compliant protects the company’s reputation and finances.

Best Practices For Accurate Accounting

Accurate accounting of software license fees is essential for clear financial records. It helps avoid overspending and legal issues. Following best practices ensures costs are tracked and reported correctly. This makes budgeting and audits easier.

Documenting License Terms

Keep detailed records of all license agreements. Note the start and end dates clearly. Record payment terms and renewal conditions. This helps track when fees are due. It prevents missed payments and unexpected charges.

Regular Audits And Reviews

Perform audits often to check license usage. Compare actual use with what was paid for. Identify any unused or extra licenses. This can save money by reducing unnecessary fees. Regular reviews keep accounts accurate and up to date.

Using Accounting Software Tools

Use software designed for tracking license fees. These tools automate calculations and reminders. They reduce human errors in accounting. Software also stores all license details in one place. This saves time and improves accuracy.

Credit: www.eliassen.com

Frequently Asked Questions

What Are Software License Fees In Accounting?

Software license fees are costs paid to legally use software. They are recorded as expenses or assets, depending on the license type and duration.

How To Record Software License Fees In Accounting?

Record software license fees as prepaid expenses if paid upfront. Amortize these costs over the license period for accurate expense matching.

Can Software License Fees Be Capitalized?

Yes, if the license provides long-term benefits, capitalize the fees as intangible assets. Otherwise, expense them immediately.

How To Handle Recurring Software License Fees?

Recurring fees are treated as operating expenses. Record them in the accounting period they relate to for proper expense recognition.

Conclusion

Accounting for software license fees is important for clear financial records. Track costs carefully and match them with the right period. Choose the right method to record expenses. Keep documents and invoices for easy reference. Regularly review your accounting to avoid mistakes.

Good habits save time and reduce errors. This helps your business stay organized and compliant. Simple steps make managing software costs easier. Stay consistent and update your records often. Clear accounting supports better decisions and planning.