Are you tired of juggling your business finances with complicated, expensive tools? Finding the best low cost accounting software for your small business can save you time, reduce stress, and keep your money matters in perfect order.

Imagine having a simple, affordable solution that helps you track expenses, send invoices, and manage taxes—all without breaking the bank. You’ll discover the top options designed just for small businesses like yours. Ready to make your accounting easier and more efficient?

Keep reading to find the perfect fit for your business needs.

Benefits Of Low Cost Accounting Software

Low cost accounting software offers many benefits to small businesses. It helps manage finances without spending too much money. These tools simplify bookkeeping and save time. Small business owners can focus more on growth and less on accounting tasks.

Choosing affordable software means getting good features that suit basic needs. It provides flexibility and can grow with the business. Easy-to-use interfaces help owners and employees handle finances without stress.

Cost Savings For Small Businesses

Affordable accounting software reduces expenses significantly. Small businesses avoid high fees for complex programs. Monthly or yearly plans fit tight budgets. This saves money for other important business needs. No need to hire expensive accountants for simple tasks.

Essential Features To Expect

Look for software with invoicing, expense tracking, and financial reporting. Basic payroll and tax calculations help stay organized. Many programs offer bank integration for easy transactions. User-friendly dashboards show clear financial overviews. These features cover everyday business accounting needs.

Scalability And Flexibility

Low cost software often grows with your business. Start with basic plans and upgrade as needed. Flexible options allow adding users or features later. This avoids switching software frequently. Adapt to new business demands smoothly and affordably.

Credit: online.jwu.edu

Criteria For Choosing Software

Choosing the right accounting software for a small business is important. The software must help manage finances easily and save time. Not every software fits all needs. Some work better for certain businesses than others. Knowing what to check can help find the best option.

User-friendly Interface

The software should be easy to use. Clear menus and simple buttons help. Users should not need special training to start. A clean design makes work faster and less confusing. Avoid software with many hidden features or complicated steps.

Integration With Other Tools

Good accounting software connects well with other apps. It should work with tools like payment processors, banks, and tax software. This connection saves time by reducing manual data entry. Integration helps keep all business data in one place.

Customer Support And Training

Strong support helps solve problems quickly. Look for software with helpful customer service. Training materials like videos or guides make learning easier. Support should be easy to reach by phone, chat, or email. Quick help prevents work delays and frustration.

Top Low Cost Accounting Software In 2025

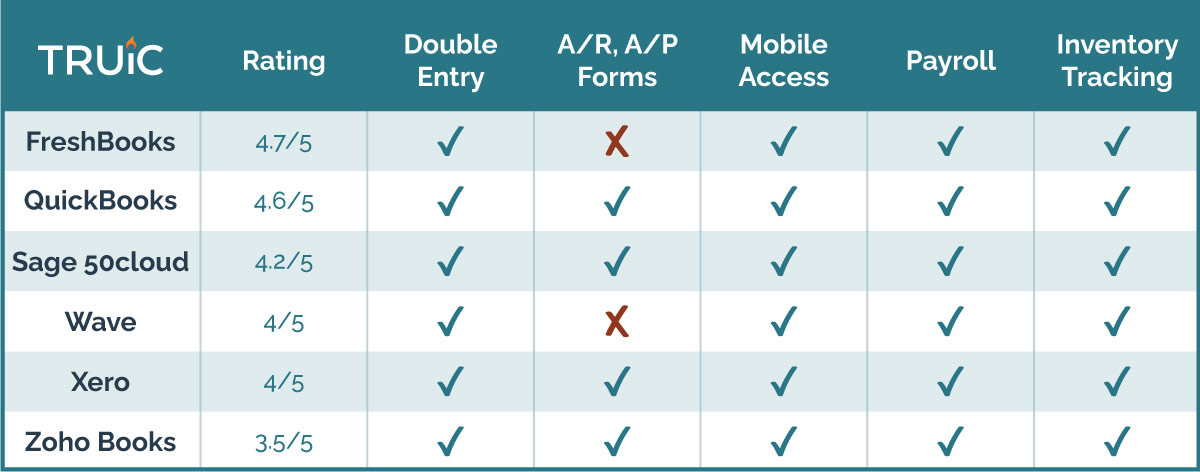

Choosing the right accounting software is essential for small businesses. The right tool saves time and money. It also helps keep finances organized and accurate. In 2025, many affordable options offer great features. These software solutions fit different business needs. Here are the top low-cost accounting software for small businesses.

Best Overall Choice

Wave stands out as the best overall choice. It offers free accounting and invoicing features. Small businesses get bank connections, receipt scanning, and reports. The interface is simple and easy to use. It covers basic accounting without extra costs. A great pick for businesses starting out.

Best For Freelancers

FreshBooks suits freelancers well. It focuses on time tracking and invoicing. Users can send professional invoices quickly. Expense tracking and payment reminders help stay on top. The pricing is low and fits small budgets. Perfect for freelancers managing multiple clients.

Best For Inventory Management

Zoho Books works best for inventory control. It tracks stock levels and purchase orders. Businesses manage products and sales easily. The software also offers strong accounting tools. Zoho Books is affordable and integrates with many apps. Ideal for small stores and product sellers.

Best Cloud-based Option

Xero is a top cloud-based accounting software. It offers real-time data and mobile access. Users can collaborate with their accountant anytime. Xero supports bank feeds and automated tasks. Monthly fees are low for small business owners. A solid choice for those needing cloud access.

Credit: howtostartanllc.com

Comparing Pricing Models

Choosing the right accounting software means understanding how pricing works. Costs can affect your budget and long-term plans. Comparing pricing models helps you pick the best option for your small business. This section explains key pricing types and what to watch for.

Subscription Vs One-time Purchase

Subscription plans charge monthly or yearly fees. They often include updates and support. This keeps your software current but costs add up over time.

One-time purchase means paying once for permanent software use. No recurring fees follow. Updates and support might require extra payment. This model suits businesses preferring fixed costs.

Hidden Costs To Watch

Some software has extra fees. These may include setup, training, or add-ons. Check for charges on extra users or features. Hidden costs increase total spending beyond the advertised price.

Read the fine print carefully. Ask providers about all possible fees before buying. This avoids surprises later.

Free Trials And Demos

Free trials let you test software before paying. Use this time to explore features and ease of use. Demos often show a guided tour of the software.

Try different options to see which fits your needs best. This helps avoid costly mistakes and ensures satisfaction.

Tips For Successful Implementation

Implementing new accounting software can seem hard for small businesses. Careful planning helps make the process smooth. Follow simple steps to get the most from your software. Focus on moving data correctly, training your team well, and keeping the software updated.

Data Migration Strategies

Start by backing up all current financial data. Check your new software’s data import options. Clean your data before transferring it to avoid errors. Move data in small parts to spot issues early. Test the migrated data for accuracy before full use.

Training Your Team

Train your team on software basics and key features. Use simple guides and video tutorials for easier learning. Schedule hands-on sessions for practice. Encourage questions to clear up confusion. Keep training ongoing as new updates come out.

Regular Software Updates

Keep your software updated to avoid bugs and security risks. Set reminders to check for new versions. Read update notes to understand changes. Install updates during low business hours to reduce disruption. Regular updates ensure better performance and new features.

:max_bytes(150000):strip_icc()/GettyImages-1442731807-de72b6667831444298d539e63d58693f.jpg)

Credit: www.investopedia.com

Frequently Asked Questions

What Is The Best Low Cost Accounting Software For Small Business?

The best low cost accounting software balances affordability with features like invoicing, expense tracking, and tax support. Popular options include QuickBooks Online, Wave, and FreshBooks. Choose based on your specific needs, such as scalability and ease of use.

How Does Low Cost Accounting Software Benefit Small Businesses?

Low cost accounting software saves money while automating bookkeeping tasks. It improves accuracy, reduces manual errors, and helps with tax compliance. This lets small businesses focus on growth instead of financial paperwork.

Are Free Accounting Software Options Reliable For Small Businesses?

Yes, many free accounting software options offer basic features suitable for small businesses. However, they may lack advanced tools or customer support compared to paid versions. Evaluate your business needs before choosing free software.

Can Small Businesses Integrate Low Cost Accounting Software With Other Tools?

Most low cost accounting software supports integration with payment gateways, CRM, and inventory systems. This streamlines operations and improves financial management. Check the software’s compatibility with tools you already use.

Conclusion

Choosing the right accounting software saves time and money. Small businesses need tools that are simple and affordable. The options shared here fit those needs well. Each software offers key features to track expenses and manage invoices. Try a few to see which feels best for your business.

Good accounting helps you focus on growth and success. Start with a low-cost option to keep your budget safe. Smart choices lead to better control over your finances.